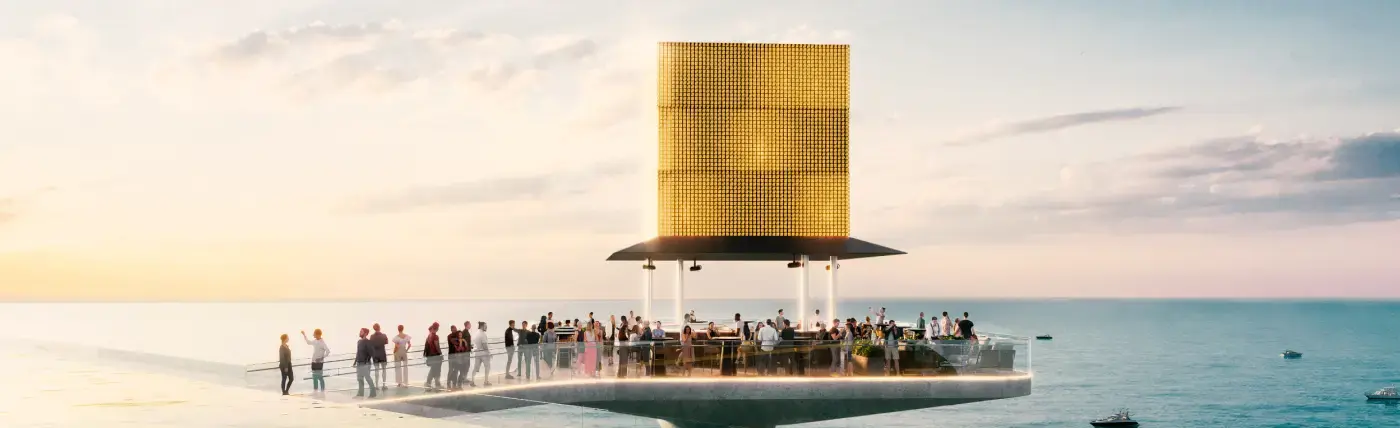

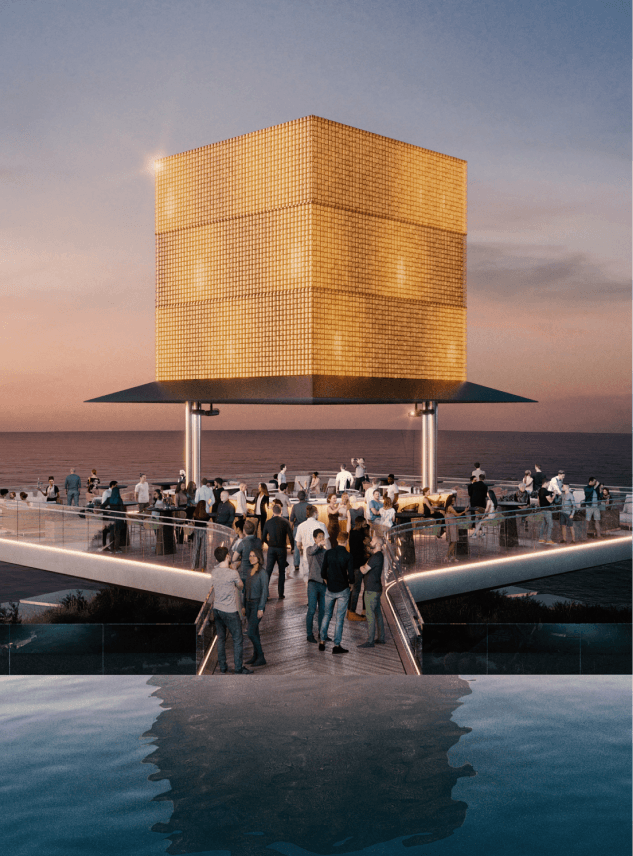

HOSPITALITY, REVISITED

CRAFTING EXPERIENCES THAT STAY

Welcome to the next chapter in remarkable living. DarGlobal is extending our residential vision into a premium portfolio of branded hotels, world-class golf resorts, and exclusive clubs. Each with our signature focus on a singular lifestyle experience.